People depend on nature, which provides a steady supply of the basic requirements for life. Energy is needed for heat and mobility, wood for housing and paper products, and we need quality, food and clean water for healthy living. Through a process called "photosynthesis" green plants convert sunlight, carbon dioxide, nutrients and water into plantmatter, and all the food chains which support animal life - including our own - are based on this plant 'matter. Nature also absorbs our waste products, and provides life-support services such as prove climate stability and protection from ultra-violet radiation. Further, nature is a source of joy and inspiration. Figure I shows how very tightly human life is interwoven with nature, a connection we often forget or ignore. Since most of us spend our lives in cities and consume goods from all over the world, we tend to view nature as a collection of commodities or a place for recreation, rather than the very source of our existence.

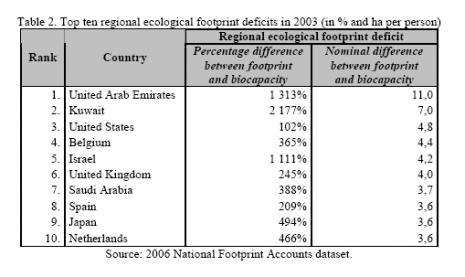

It is necessary however to promote those technologies and ideas which guarantee achieving sustainable development, i.e. satisfy human needs under the condition of environmental protection. Second, more restrictive international agreements on pollution reduction must be adopted and implemented. One of “Alexandrian” ideas of achieving sustainability may be to trade human ecological footprint deficits and surpluses between countries, regions and enterprises.

Lifestyle tax proposals – The policy options include two proposals to promote wellness and healthy choices, and curb activities that increase overall health care costs.

Increase Taxes on Alcoholic Beverages – Current law imposes an excise tax on alcoholic beverages, charging $13.50 per proof gallon, which translates to about 21 cents per ounce of alcohol. Because of this measurement, the excise tax treats different types of alcohol differently. Beer is measured by the barrel and the tax rate per barrel is $18 or about 10 cents per ounce of alcohol. The current tax on wine is $1.07 per gallon or about 8 cents per ounce of alcohol. The policies present the option of standardizing the tax on alcohol and increase the excise tax to $16 per proof gallon.

Impose an Excise Tax on Sugar‐Sweetened Beverages – Sugar‐sweetened beverages contribute to obesity which drives up health care costs within the system. The policy options would expand on what some states have already done by imposing a federal tax on beverages sweetened with sugar, highfructose corn syrup, or other similar sweeteners. The tax would not apply to artificially sweetened beverages.

Source: BAUCUS, GRASSLEY RELEASE POLICY OPTIONS

FOR FINANCING COMPREHENSIVE HEALTH CARE REFORM

Options are the final of three papers in Finance leaders’ health reform effort

Fish is but one example of products with large environmental impacts (ie: overfishing and ecological invasion) that are difficult to keep straight and not reflected in an item's price.

Sometimes, simple acts such as going to the grocery store can turn into a moral dilemma. Is it better to choose the piece of organic fruit produced on the other side of the country or the non-organic version grown locally, 50 miles away? Are the benefits of chemical-free shampoo worth an extra 5 bucks a bottle? Will I really be able to enjoy a cheap chocolate bar knowing that the growers of the cocoa beans were likely not fairly compensated?

As much as I’d like to say that I always buy the product that is environmentally safe and sustainably produced, in reality, that’s not always the case. First, the sheer amount of information required to be able to distinguish between products is staggering. You need facts regarding environmental impact, transportation costs, and fair trade practices, to name just a few. And there are plenty of misinformation and greenwashing campaigns out there to steer you in the wrong direction.

Second, of course, there are times when the high cost of an ethically made product turns me off from buying it. Even consumers with the best of intentions have their breaking points.

The thing is, companies who go out of their way to implement sustainable practices endure a greater cost of production. Sure, they can sometimes capitalize on this by marketing to conscientious consumers who are willing to pay a bit more, but the fact remains that in today’s system, environmentally minded production is punished.

On the other hand, companies who move their factories (and jobs) to developing countries with lax environmental standards and cheap labor are able to make products at a fraction of the cost and undercut their competitors (while shipping materials and finished goods all around the world and adding to our greenhouse gas problems).

The way it’s set up, high environmental standards in one country drive companies to relocate in places where it’s permissible to pollute in order to compete in the marketplace. Chaco, the Colorado-based athletic sandal company, is a prime example of even a well-intentioned company being forced to follow suit to maintain competitive pricing on their products. In fact, 95% of all footwear in the world is produced in China, whose poor environmental regulation and sometimes dangerous environmental problems are well known.

With current talk about cap and trade emissions programs, this phenomenon may only get worse.

So how do we even the playing field and reward companies for good business practices?

When I think about this problem, I keep coming back to an idea I encountered in a casual conversation with a stranger while traveling. I can’t remember his face or his name, but his idea has stuck with me and festered in my mind for the better part of a year. His take was that putting the financial burden of environmental responsibility on the companies just doesn’t make sense for the reasons I’ve given above. In a global marketplace, it renders companies less competitive than those that operate free of environmental and labor regulations.

Wouldn’t it make more sense to put an “environmental impact” or “ecological footprint” tax on the product itself?

Ugh, a tax?

Initially, I didn’t warm to the idea either. But think about it: adding a tax proportionate to a product’s ecological and social footprint eliminates the cost advantage of irresponsible production. All those environmental costs that are currently not included in our economic system would be factored in and would increase the price of unsustainably made products.

This, in turn, would make moral dilemmas at the grocery store much easier. Is it more sustainable to buy distant, organic produce or local, non-organic produce? The tax-adjusted pricing should inform my decision. Can I afford the chemical-free shampoo? Yes, because the price of its chemical-laden competitors would be raised through the environmental impact tax and eliminate the cost advantage of choosing that product.

The money raised from the tax could fund its implementation and other sustainable programs such as public transportation (high speed rail, anyone?) and alternative energy. Perhaps it could even make a dent in our gaping budget deficit.

Won’t this cost me money?

You may be thinking, “Sure, that’s a good idea in concept, but that will raise my bills – grocery, clothes, everything.” Well, yes, that’s true. But maybe if we see the true cost of the products we casually consume, we can make a more informed decision about what is really necessary to our lives.

Additionally, programs such as this often have the greatest impact on the poor. But this could be compensated for by using some of the tax revenue for need-based assistance programs.

Regardless, running an economic system on the assumption of infinite resources is fundamentally flawed. Currently, environmental impacts such as air pollution, water pollution, and deforestation are not factored into the cost of a product: they are considered “externalities.”

These costs need to be included in the system in a way that does not punish those who engage in sustainable business practices. By taxing a product’s environmental impact, it levels the playing field for the consumer.

Disclaimer

Of course, I am not an economist or policy guru. I don’t know how to implement such a tax or if it would even be possible (though compared to creating a carbon trading market, perhaps it’s not that difficult). This is only the musing of a concerned, intelligent citizen trying to brainstorm ways to make our economic system fit within the bounds of our ecological constraints.

What do you think? Would such a tax have a beneficial effect on our production system?

Ecological Footprint Calculators

EarthDay Footprint QuizAllows to choose your country and language, and calculate your footprint based on shelter, food, transport. After the test you can "play" with individual items like the type of food you eat to evaluate the impact it will have on your footprint.

Redefining ProgressRedefining Progress works with a broad array of partners to shift the economy and public policy towards sustainability.

Good FAQ list with more details plus spreadsheet with conversions to EFPollution Calculators - Reduce Your Ecological Footprint

The Carbon Neutral Company CalculatorsCalculate your flight emissions. Airline flights are one of the biggest causes of CO2. Here you can calculate precisely the emissions of any airline flight in the world and offset them by flying Carbon Neutral in 3 easy steps.

Travel CalculatorThree calculators - to calculate your pollutant emissions from your journeys by road, calculate the energy you use on your journeys (in calories), and calculate the full annual cost of car ownership..

Miles/km conversion. For easy mileage (mpg) vs l/100km conversion click

here.

Commuting Cost CalculatorUse the calculator to find out the true cost of your own drive-alone commute, or

click here to find out how much your commute costs the earth. How much do you spend on your commute? It may be more than you think.

Electricity PollutionUse the Infinite Power Pollution Calculator to find out how much pollution is in the electricity you use every day.

Electricity PollutionThe Cleaner And Greener calculator will return the emissions of your electricity use based on your consumption and the state you live in. This one looks at CO2, VOC, NOX, SO2, CO, PM10, mercury.

Electricity PollutionThis electricity pollution calculator allows you to choose the type of powerplants.

Generic appliance electricity calculator.

Pollution Reduction - Energy Efficient BuildingsFind out how much money you can save and the pollution you can reduce by investing in energy efficiency in your home or workplace, from Cleaner And Greener.

AAA Fuel Cost CalculatorThe AAA Fuel Cost Calculator estimates the amount and cost of gasoline needed to complete a vacation trip.

TrackYourGasMileage.comOn TrackYourGasMileage.com you can keep track of your vehicle's gas mileage history. By tracking your mileage over time, you can see how much money you are spending on gas, how your vehicle's gas mileage is developing, and paint a picture of the overall health of your car!

Other Ecological Calculators

WarmAir.com - Energy Conservation CalculatorsHere you can estimate energy conservation by improving: attic insulation, windows, heat exchangers, air conditioners with higher SEER, thermostat set-back, etc...

Solar Hot Water CalculatorHow much would an investment in a solar water heater save you in energy costs?

Grid-tie PV Performance CalculatorPVWATTS calculates electrical energy produced by a grid-connected photovoltaic (PV) system. Currently, PVWATTS can be used for locations within the United States and its territories. Researchers at the National Renewable Energy Laboratory developed PVWATTS to permit non-experts to quickly obtain performance estimates for grid-connected PV systems.

Nutrition CalculatorLets you input the type (frozen, raw, baked, ...) and amount of any kind of food and you'll get the nutritional information of your meal or monthly diet. It will also recommend you any additional food based on your data that may help if you have nutritional deficiencies.

Air Pollution IndicatorScore Card lets you indicate where you live and will tell you how much and what is being released in the atmosphere and by who.

Calorie Intake Calculator Calculate approximately how much energy you burn during the day.

The real car cost CalculatorThis calculator will help you find out the total cost of your car and how much you might have saved at retirement age should you not have owned a car (you'll get quickly at +half a million dollar!)

Ecological Footprint Companies & Organizations

Best Foot ForwardDesign and develop tools to measure and communicate environmental impact and sustainability.

CarbonCalcProfessional calculator software from Best Foot Forward aimed at companies to calculate their gas emissions. The CarbonCalc software helps you to collate your consumption data and uses this to estimate your greenhouse gas emissions. CarbonCalc covers all six Kyoto Protocol gases and is thus compatible with emerging international standards including the DETR Environmental Reporting guidelines in the UK.

An ecological footprint lifestyle tax as opposed to an "income" tax is long overdue and inevitable.

ReplyDelete