Friday 04 February 2011

by: Terrance Heath | Campaign for America's Future | News Analysis

"Now that he is safely dead, let us praise him." poet Carl Wendell Hines wrote of Martin Luther King Jr, after his assassination. Ronald Reagan has been "safely dead" for just under seven years, but the economic impact of his policies remain with us.

In a sense, it's highly appropriate that the centennial of Reagan's birth falls upon us in the midst of a economic nightmare from which it is uncertain when — or if — the nation will awaken. Though we will be inevitably awash in conservative praise and hagiography of Reagan, his 100th birthday is also an occasion to remember how America's long economic nightmare began.

It's a story told many times, but it bears telling again, and again, as David Johnson did last year as he explained how the "Reagan Revolution" came home to roost. He even told it in charts.

As Dave said in his post. take a look at a chart of almost anything, and you'll notice that right around 1981, things take a sharp turn in the wrong direction — that is, for just about everyone but the wealthiest 1%.

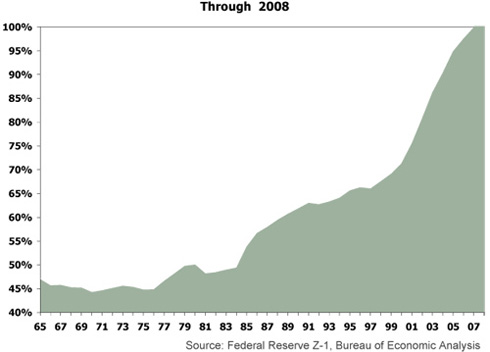

Conservative policies transformed the United States from the largest creditor nation to the largest debtor nation in just a few years.

And it started with Reagan. Anyone who's wringing their hands about America's debt and China's ownership of it has Reagan to thank, as Reagan's former budget director David Stockman recently explained to David Corn.

Here's how Stockman tells the tale. In the '80s, Reagan and his White House crew were eager to cut income taxes across the board. The aim, he asserts, was to fix the slumping economy, not to starve the beast of big government. Republican leaders on the Hill were initially skeptical—they insisted that the White House pass spending cuts before Congress tackled the tax side. "The honest-to-goodness fact," Stockman says, "is that in February 1981, there wasn't close to a Republican majority for tax cuts without any accompanying or coupled spending cuts. The idea of supply-side in its purest form"—that tax cuts fuel economic growth that yields increased tax revenues—"was only embraced by a handful of junior Republicans, plus Jack Kemp."

The Reagan administration hardly minded proposing massive cuts to both taxes and spending. But then things went haywire, Stockman notes. The tax cut ballooned from $500 billion over five years to $1 trillion after lobbyists added special-interest tax breaks for various industries. And on the spending side, the Reagan administration went hog-wild throwing money at the Pentagon. The inevitable happened: The deficit ballooned.

...The new doctrine got a boost when it turned out you didn't have to match tax cuts with spending cuts: The Federal Reserve was able to sell the nation's growing debt to China and others. "It totally anesthetized the political system to the costs of deficit spending," Stockman says. "Therefore the simplistic and reckless idea that the way to stimulate the economy is to cut taxes anytime, anywhere, for any reason, became embedded [in the GOP]. It has become a religion, it has become a catechism. It's become a mindless incantation."

As Paul Krugman wrote in 2009, we weren't always a nation of big debts. He went on to explain how it started with Reagan.

“This bill is the most important legislation for financial institutions in the last 50 years. It provides a long-term solution for troubled thrift institutions. ... All in all, I think we hit the jackpot.” So declared Ronald Reagan in 1982, as he signed the Garn-St. Germain Depository Institutions Act.

He was, as it happened, wrong about solving the problems of the thrifts. On the contrary, the bill turned the modest-sized troubles of savings-and-loan institutions into an utter catastrophe. But he was right about the legislation’s significance. And as for that jackpot — well, it finally came more than 25 years later, in the form of the worst economic crisis since the Great Depression.

...The S.& L. crisis has been written out of the Reagan hagiography, but the fact is that deregulation in effect gave the industry — whose deposits were federally insured — a license to gamble with taxpayers’ money, at best, or simply to loot it, at worst. By the time the government closed the books on the affair, taxpayers had lost $130 billion, back when that was a lot of money.

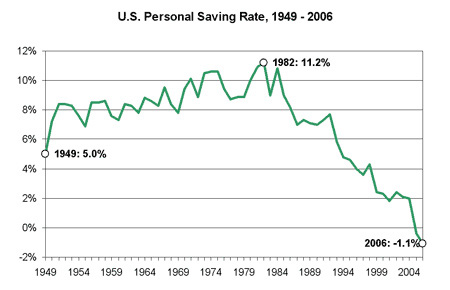

But there was also a longer-term effect. Reagan-era legislative changes essentially ended New Deal restrictions on mortgage lending — restrictions that, in particular, limited the ability of families to buy homes without putting a significant amount of money down.

These restrictions were put in place in the 1930s by political leaders who had just experienced a terrible financial crisis, and were trying to prevent another. But by 1980 the memory of the Depression had faded. Government, declared Reagan, is the problem, not the solution; the magic of the marketplace must be set free. And so the precautionary rules were scrapped.

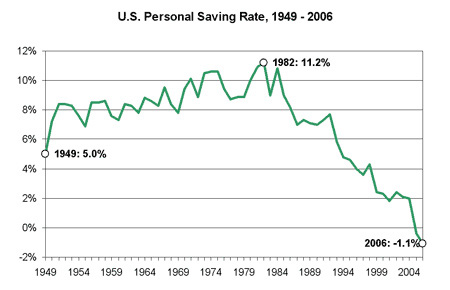

Together with looser lending standards for other kinds of consumer credit, this led to a radical change in American behavior.

Revisiting the Reagan ruins earlier this week, Robert Borosage explained that Reagan's deregulatory fervor essentially gutted consumer protections.

Deregulation gutted consumer protection, environmental protection, workplace safety and the right to organize under Reagan. It led to many scandals that made his administration one of the most corrupt in history, with a record 138 officials investigated, indicted or convicted. But the biggest change was deregulation of banking, which led to successive financial wildings and crashes that have cost taxpayers literally trillions. The first was the Savings and Loan debacle that followed on Reagan's reforms that empowered banksters to gamble with other people's money, with their losses guaranteed by the federal government.

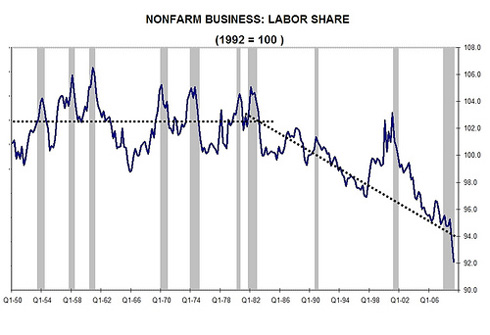

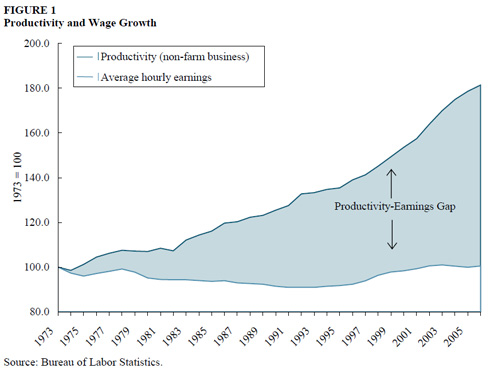

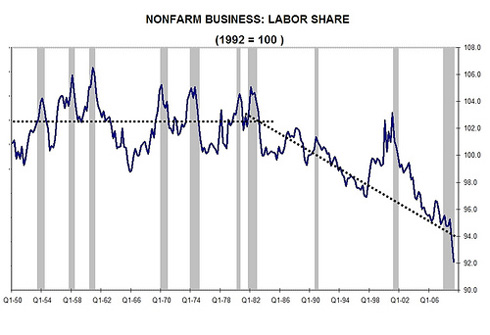

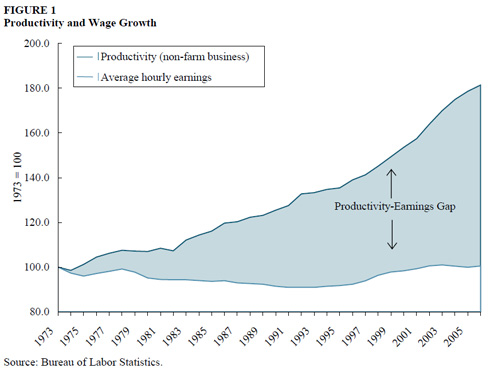

Working people's share of the benefits from increased productivity took a sudden turn down.

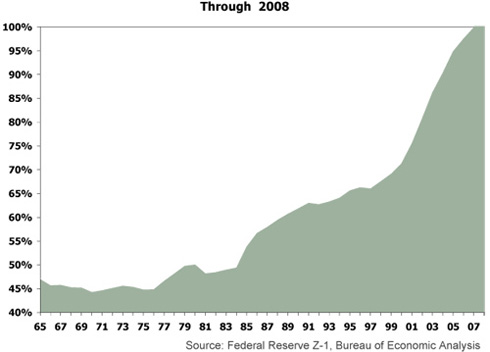

In the column quoted above Krugman also wrote that the increase in public debt was dwarfed by the increase in private debt, made possible by Reagan's deregulation. "It's the gift that keeps on taking," Krugman wrote. Taking, that is, from working people.

As Johnson explained in his post

Working people's share of the benefits from increased productivity took a sudden turn down:

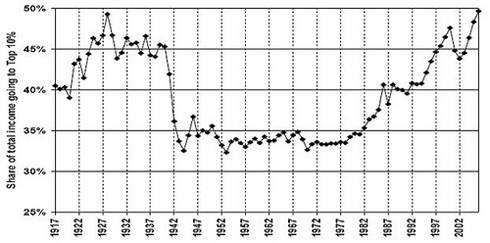

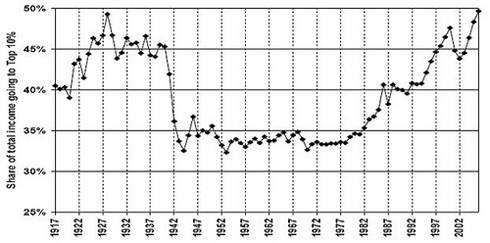

This resulted in intense concentration of wealth at the top:

But don't take my word for it, or even Dave's. When Michael Moore contended in Capitalism: A Love Story that productivity went up during the Reagan years, while wages were frozen, Politifact (mostly) backed him up. So did the August 24, 1988 edition of the New York Times.

Not every pocketbook statistic, however, reflects so rosily on the Administration's performance. Real wages have slipped since 1980, and now are about 10 percent below the peak of 1972. Thus Mr. Bush's claim that average incomes are at a record high today only reflects the fact that more families have a second earner in the work force.

Nor is there reason to be optimistic that wage stagnation will soon end. Productivity gains, which largely determine wage increases in the long run, have slowed to a crawl in the last two decades and show little sign of revival. Moreover, America's rapidly accumulating debt to foreigners is sure to become a drag on domestic purchasing power.

Also, per Dave's earlier instruction, notice what happens right around 1981 in this chart from a 2007 Center for Economic Policy Research report, "The Productivity to Paycheck Gap: What the Data Show," (PDF) by Dean Baker.

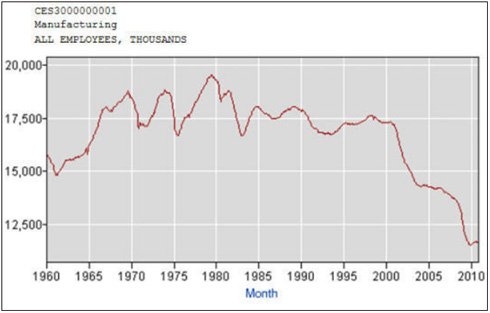

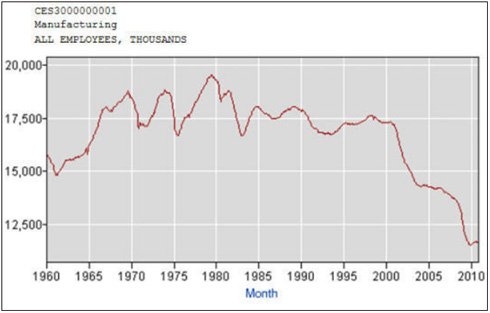

If workers didn't fare well under Reagan, perhaps it's because Reagan wasn't exactly a friend to working people.

Reagan's war on labor as US president began in the summer of 1961, when he fired 13,000 striking air traffic controllers and destroyed their union.

As Washington Post columnist Harold Meyerson noted in 2004, the firing was "an unambiguous signal that employers need feel little or no obligation to their workers, and employers got that message loud and clear - illegally firing workers who sought to unionize, replacing permanent employees who could collect benefits with temps who could not, shipping factories and jobs abroad."

Reagan gave dedicated union foes direct control of the federal agencies that were originally designed to protect and further the rights of workers and their unions. Most important was Reagan's appointment of three management representatives to the five- member National Labor Relations Board (NLRB).

The appointees included NLRB Chairman Donald Dotson, who declared that "unionized labor relations have been the major contributors to the decline and failure of once healthy industries" and have caused "destruction of individual freedom."

A House committee found that under Dotson, the NLRB abandoned its legal obligation to promote collective bargaining, in what amounted to "a betrayal of American workers."

As Borosage noted, that betrayal of American workers extended to "free trade" and the shipping of jobs abroad rather than goods.

As the New York Times back in 1988, not all pocketbook statistics reflected rosily on the Reagan administration's performance, but some did — and still do. At Open Left, Paul Rosenberg illustrates with a series of charts in his post "The failure of voodoo economics in pictures," what Sam Pizzigati explained in his final report card on the Reagan years.

Americans in the overall top 1 percent, the 2007 CBO data showed, did quite well in the Reagan era's first quarter-century. Their average incomes, after taking inflation into account, essentially tripled, rising 201 percent.

But these top 1 percent stats, the new CBO data help us understand, hardly tell the full story. The truly stunning income increases over recent decades have gone to the tippy-top of the U.S. income distribution, not the top 1 percent, but the top tenth — and top hundredth — of that top 1 percent.

The higher up you go on the income ladder, in other words, the sweeter the Reagan era.

Between 1979 and 2005, the bottom half of the top 1 percent saw their average incomes only double, after inflation. These incomes increased 105 percent. The next highest four-tenths of the top 1 percent somewhat raised the income bar. Their average incomes, after inflation, rose 161 percent.

That brings us to the top 0.1 percent of Americans. Their incomes, from 1979 to 2005, rose a staggering 294 percent after taking inflation into account. Not bad at all. But the top 0.01 percent did even better. The 11,000 households in this rarified air took home an average $35.5 million in 2005, a 384 percent increase over average top 0.01 percent incomes in 1979.

A lot happened after Reagan saddled up and rode off into the sunset, but nothing has yet been sufficient to rouse America or it's economy from the nightmare that ensued. Even now we live not only with the economic consequences of his "cut and spend" conservatism, but we are haunted by the narrative he established in his 1981 inaugural address: "government is not the solution to our problem; government is the problem."

This is the narrative that haunts us to this day; haunts us and hampers us from taking bold action to solve the problems facing America. It hampers us because it frames us as separate from government.

Government in Reagan's narrative became "the government," not "our government." The success of Reagan's narrative, all the way up to the reforms of the Obama administration and the previous Congress, have effectively scaled down our ability to address problems to large in scope to be effectively addressed by state or local governments, let alone by non-government organizations or on an individual basis.

Reagan's genius was to step into a period of uncertainty and focus the fear and anxiety of America on the government as the enemy. What he was really saying was "Whatever happens, you're on your own."

His self-appointed heirs are as haunted as the rest of us.

These days, no Republican with national ambitions will miss an opportunity to remind us of his or her Reaganesque bona fides. Reagan's precepts of a smaller government, a bigger military, lower taxes and conservative social policies demand absolute fealty.

The irony is that Reagan would not have become such a transformational figure if he had not challenged the political orthodoxy of his own time. His self-declared legatees invoke his name as a pledge to do the opposite, a reassurance that they will not venture beyond what has become conventional thinking in the GOP. What starts as a touchstone, however, can over time become a millstone, if history is any indication.

As a child of the 80s, who grew up during the Reagan era, I'm reminded now of Nightmare on Elm Street, a horror movie release in 1984, about a group of children who grew up haunted by a murderous ghost who menaced them into adulthood, until (sometime later in the series) his memory was finally banished.

As an adult, now, living amid the ruins of the Reagan era, I can only hope we will soon wake from our shared nightmare and — if not banish his memory — at least final strip it of its destructive power, reclaim our own, and allow the nightmare to fade into memory.

All republished content that appears on Truthout has been obtained by permission or license.

No comments:

Post a Comment