MWM MarketCycle Wealth Management

MarketCycle Wealth Management, LLC

CURRENT MARKET UPDATE (updated weekly): The bull market that began in March of 2009 remains fully intact despite continued severe problems in Europe. We have survived the second of the two major corrections predicted by MarketCycle Wealth Management and we are likely currently attempting to enter the third and final leg up of this “cyclical” bull market. Final legs up are usually fairly strong. As the new month starts, the market is short-term overbought and it WILL find reasons to pull back temporarily before heading higher. MarketCycle’s clients remain 100% invested globally-diversified-long (but with an un-triggered automatic hedging order in place that would move client’s accounts to neutral if necessary, should the market proceed lower). Our specific positions (stocks, bonds, commodities, alternative assets) remain confidential. ********** On a positive note: The 10 year US Treasury-Bond is now 2 standard deviations below the dividend earnings yield of the S&P-500. This has happened 57 times in the past four decades, and in 96% of these periods, stocks (particularly dividend paying stocks) and “Treasuries Inflation Protected” (TIPS) were up very significantly one year later. MarketCycle rotated our clients into (non-financial) high-dividend paying international and emerging market stocks and into US-TIPS and other “inflation” alternative assets, at or near the recent market correction bottom. ********** For this month’s economic/investing blog, please continue reading.

CAUTION: I realize that this month’s blog is VERY politically incorrect toward both political parties (equally), but it is not my intent to offend anyone’s ideology. I do believe that all of us can agree that the US Government is broken and that it has been for some time. I further believe that we can all agree that the biggest of the banks are fully corrupt and that they financially sponsor both political parties. This great country deserves better.

The American people are starting to realize that, in most Presidential elections, they are offered one choice between two people that are basically incapable of doing the difficult job of running the US Government. Could you imagine Apple Computers bringing in some of these choices as their new CEO? Perhaps honest, ethical, frugal, intelligent, free-thinking, independently minded candidates are hard to come by; perhaps they would be un-electable to any government position under current laws and conditions.

HERE IS WHAT HAPPENED (economically) TO GET US TO WHERE WE ARE TODAY:

Democrat John F. Kennedy doesn’t like how inflation numbers are reported because the Vietnam War is costing so much and causing such high inflation and he doesn’t want anyone to know, so he permanently changes the calculations so that it looks like inflation is lower than it actually is… every President that comes after him will follow his lead by making further changes to the inflation measuring calculation… the result is that everything costs much more with each passing year, but none of the rising costs can possibly be “real” because it appears that there is no longer any high inflation →

Democrat Lyndon B. Johnson borrows endless amounts of money to fund the ever escalating Vietnam War that had started with President Kennedy and he also starts the US on ”unified budget” accounting which rolls in-coming Social Security money into the general budget, where it is then spent… the US debt problem begins in earnest at this point →

Republican Richard Nixon takes the United States off of the “Gold Standard” and paves the way for extreme inflation and future asset “bubbles” because of the US Government’s new ability to print money “at will” (because the “worth” of money no longer has to be backed-up by an asset)… for his first 6 years he escalates the Vietnam War even further, causing even greater inflation, but then removes “food & fuel” from the US inflation measures resulting in false (lower) inflation numbers being reported →

Democrat Jimmy Carter asks Fed Chairman Paul Volker to raise interest rates high enough to “break the back” of the inflation that was caused by borrowing to fund the Vietnam War… the economy is temporarily destroyed, but the inflation must be stopped before a loaf of bread costs $20… with the economy in tatters but inflation totally conquered and deflated, the US is set up for a 20 year period of slow re-flation, which means a booming economy, and the next 3 presidents will reap the benefits and, frankly, get the credit →

Republican Ronald Reagan is elected with the economy in shambles, but with the enemy of inflation now conquered for the next 20 years… importantly, he allows banks to package mortgage loans into bonds and sell them to investors, and then goes on to promote the de-regulation of almost everything, but especially the media and the financial markets, and he removes the tax incentives that had been put in place for alternative energy (by Carter) and gives them to oil companies… in 1986, Reagan orders the United States Department of Commerce to begin a series of seminars, held in resorts throughout Mexico, and its topic is: ”why employers should move their manufacturing plants to Mexico” →

Republican George Bush (I) pushes his self proclaimed ”New World Order” agenda (his words, not mine) and is the first President to actively start to send jobs out of the United States, and into Central America →

In an attempt to appease Congress and get impeachment proceedings off of his back, Democrat Bill Clinton signs Republican Phil Gramm’s “Commodity Futures Modernization Act” which essentially deregulates deposit banks and allows them to take on risky investments (similar to investment banks) in order to boost their bottom line (and at the expense and risk of their depositors)… President Obama will later ask Phil Gramm to come in and advise him on financial matters →

Bill Clinton adopts affordable housing as one of his explicit goals (not lower home prices, but easier access to credit… which really means “debt”) →

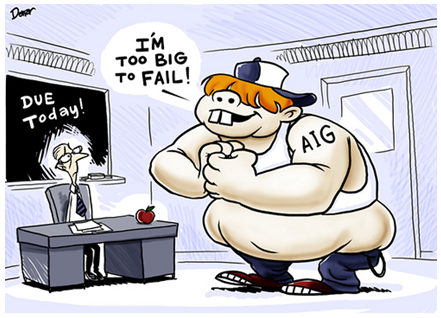

Bill Clinton signs legislation (that has been pushed through by banking lobbyists) that will allow big banks to merge into giant banks that are “too big to fail” →

Clinton works tirelessly to push his, again, self proclaimed ”New World Order” free trade agenda (his words, not mine) that will ultimately end up sending increasingly high numbers of American jobs overseas (NAFTA and GATT and WTO)→

Vice Presidential hopeful and oil-man, Dick Cheney, gives a late 1990′s speech where he lets the “cat out of the bag” and acknowledges that the world has reached the peak in oil production, is rapidly running out, and that the United States must find a way to “secure” Middle East oil supplies and the Iraqi oil fields in particular… this is especially important since the US has already drained most of its own oil fields →

Newly elected President George Bush II, after having previously sold his worthless Texas oil corporation for a huge sum, (it was appropriately named “Arbusto” and it had Osama bin Laden’s brother [Salem] as a major shareholder as well as other notable Saudi investors), Bush makes a speech to the American public stating that “the American way of life is not negotiable” and that we will “Shock and Awe” oil rich Iraq because a handful of independent Saudi terrorists living in Afghanistan have attacked Wall Street with planes… then he blames the stock market fall, that began in 1999, on the late 2001 plane attacks →

Republican George Bush II makes Goldman Sachs’ Hank Paulson head of the US Treasury after Paulson had successfully lobbied to allow financial institutions and banks to utilize derivatives AND almost unlimited amounts of extremely risky leverage on investments (a great combo, as we would soon learn)… Hank Paulson had come to Washington’s attention when he was Staff Assistant to John Ehrlichman when Ehrlichman master-minded the Watergate break-in for then President Richard Nixon… and now, after leaving Goldman and becoming head of the US Treasury, he allows Lehman to go under, but bails out AIG (he neglected to mention publicly that Goldman Sachs had $20,000,000,000.00 worth of credit-derivative transactions tied up in AIG)… a nice bonus is that Paulson sees that Goldman Sachs gets an additional $13,000,000,000.00 of the bailout money that first went to AIG, while everyday AIG shareholders get to see their investments wiped out →

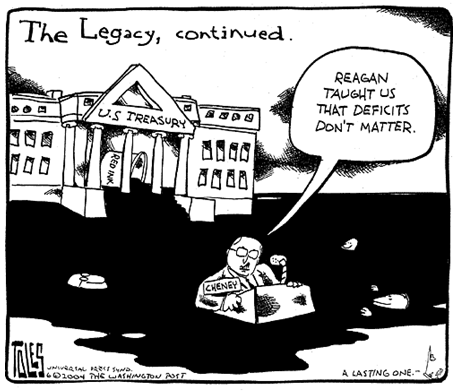

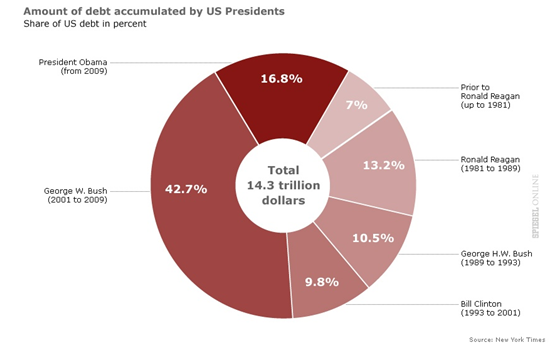

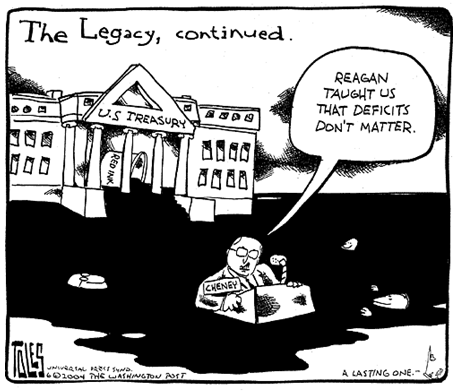

Bush II and Dick Cheney declare that “deficits don’t matter” as they give the government’s surplus of money back primarily to wealthy Americans… this money could have been used to re-jump start the economy during the “Great Recession” rather than putting the burden on the backs of future American workers… (but they also drop the tax rates on investments down to 15%, which is a good thing since the money has already been taxed when originally earned) →

Bush II promotes and signs legislation that will give huge amounts of money to drug companies in his new Medicare drug program… no one notices that it is not Social Security that will ultimately destroy the government’s coffers, rather it is Medicare and drug-care that will continue to grow at astronomical rates into the future →

Bush orders the government to stop allowing its citizens to know what M3 money printing levels are… leaving “we the people” in the dark as to exactly how much total money is being printed or exactly how it is being used in the financial markets or how high the potential for hyper-inflation is (M3 is still not being reported) →

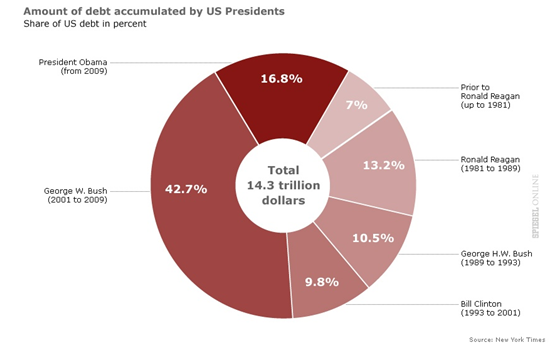

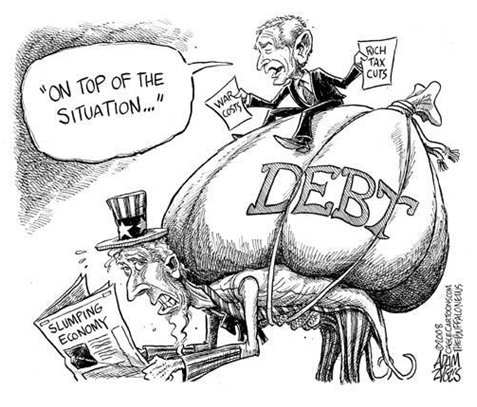

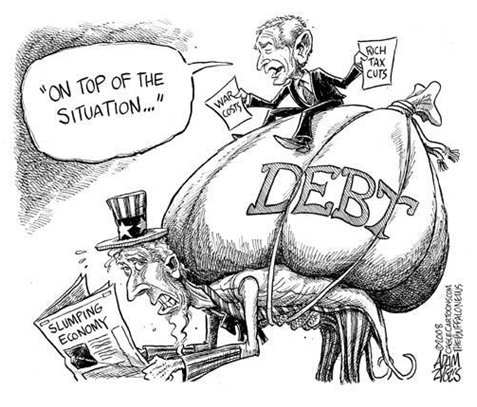

During the Bush administration’s tenure, the US will run up more debt than that created by all of the first 41 Presidents combined… (and the current Obama administration is working to catch up) →

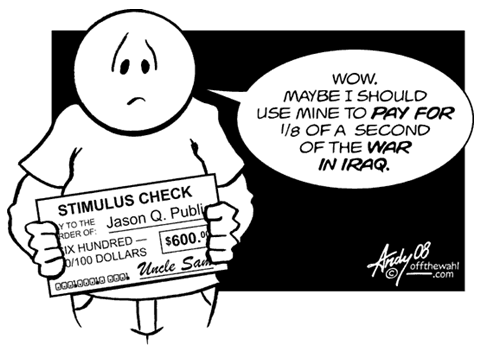

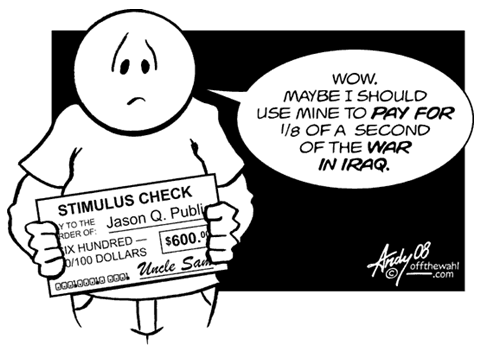

President Bush and Congress lead the way to US involvement in 2 wars and the cost will tally up to almost $3,000,000,000,000.00 before Obama can bring the troops “home” at the beginning of 2012… but on 10/29/11, the government announces that “home” is really Kuwait, so there will be minimal financial savings from the withdrawal →

weapons, especially land mines, missiles and tanks, once again become the number one export of the United States… and the number one import becomes oil… the trade deficit levels come down temporarily and everyone is happy →

Greenspan reduces interest rates to 0% after the technology bubble bursts (all bubbles eventually burst) and this allows people to borrow, and go in debt, at unbelievable rates (pun intended) →

people start to borrow in order to buy real estate with the lowest interest payments in history →

the ”worth” of properties soar →

people begin to extract the profits out of their homes, taking on larger mortgages, and they put the money into the stock market →

the “worth” of the stock market soars →

hedge funds begin to use 10x-leverage on illiquid financial assets, which means that a 10% loss creates an actual 100% loss and the hedge funds have the potential to wipe out 100% of their investor’s money (and of course, anything that can happen will [and does] eventually happen) →

(I just had to add this next cartoon, even though it isn’t really funny, ’cause I look at charts all day long!)

in order to keep new people buying real estate, “sub-prime” adjustable-rate mortgage loans are offered at no initial interest, no down payment, to borrowers that don’t have jobs or the ability to pay →

Greenspan repeatedly goes on television and suggests to anyone who will listen that they should immediately go out and get “adjustable rate mortgages” →

the de-regulated deposit banks could now package the new toxic sub-prime adjustable rate mortgages and pass them on to Wall Street who re-packages them and then turns around to offer them to unwary investors… the banks, such as Goldman Sachs, then take out billions of dollars’ worth of derivatives contracts essentially betting against the very same securities that they had just sold to their investors (and no one ends up in jail for this) →

the financial institutions that are pushing these toxic assets PAY the ratings agencies (the same ones that just downgraded the United States) to give the toxic assets their highest ratings →

the real estate bubble bursts, as all bubbles eventually do, and prices turn down sharply →

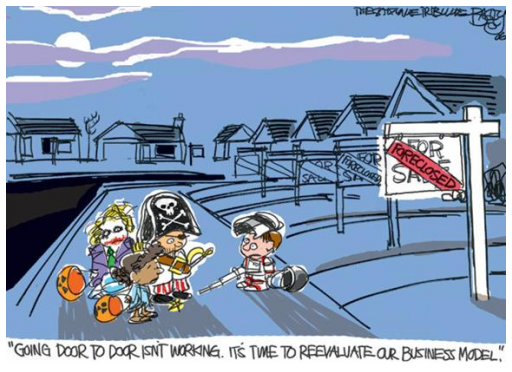

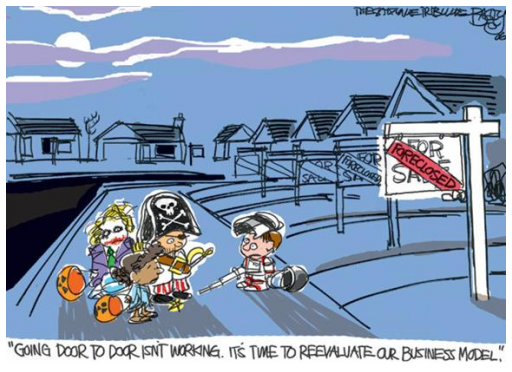

the already toxic mortgages were now worthless and still are, except that most of the mortgages are now owned by you, me and our grandchildren… many of the foreclosed houses are sitting vacant, (which may have confused children during Halloween) and many foreclosures are left on the books of the banks as “assets” so that the banks appear, on paper, to be stronger than they really are (and this will eventually back-fire on them, and us, during the next recession) →

the stock market collapses along with the very asset (real estate) that had allowed people to drive up the price of the stock market →

banks were left still holding toxic assets on their books; they had been unable to sell ALL of the toxic mess to confused investors →

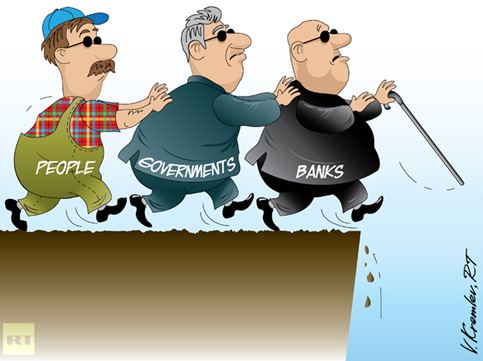

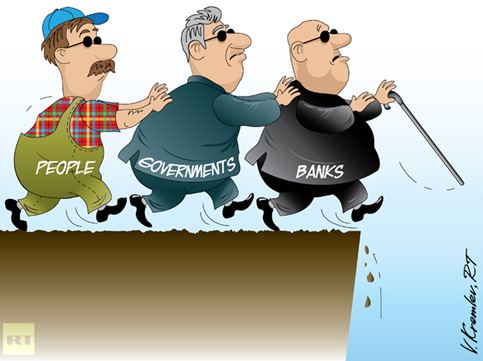

the banks financially support and influence the politicians in Washington, DC →

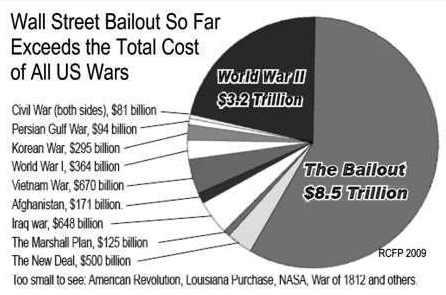

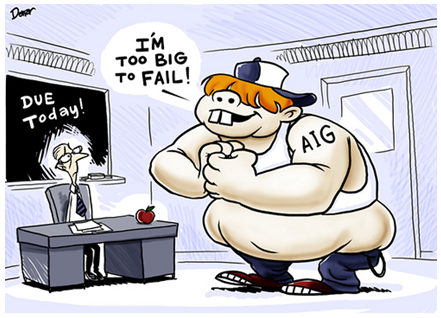

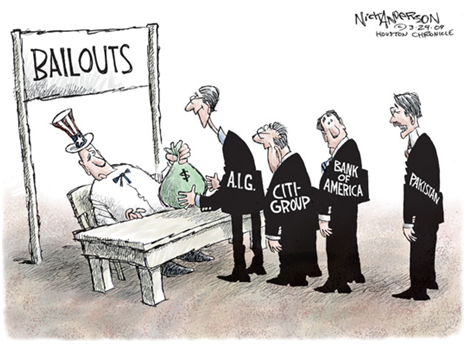

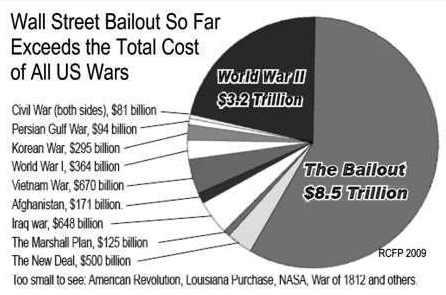

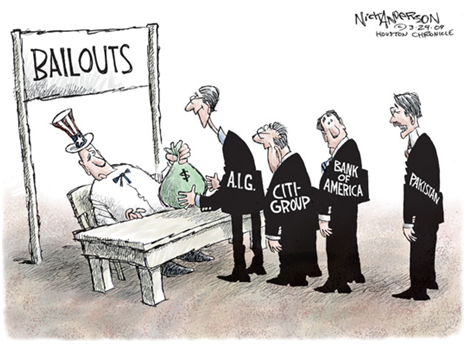

Congress decides that “we the people” will bail out the corporate banks because the banks are now ”too big to fail” (AIG, Bank of America, Citigroup, JPMorgan Chase, Wells Fargo, Goldman Sachs, Morgan Stanley and ___); the eventual price of the total bailout comes to $8,500,000,000,000.00… and this is a very large number →

people lose money in their homes, lose money in the stock and commodity markets, and are now responsible for bailing out the corporate banks after having also lost their jobs (8,000,000 jobs disappeared) →

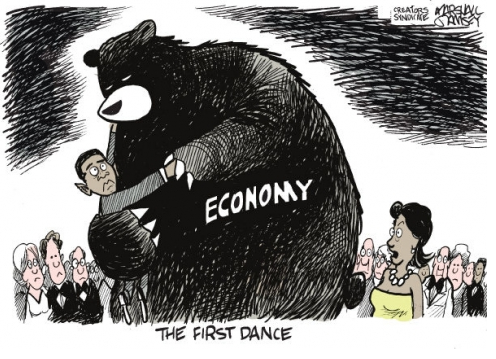

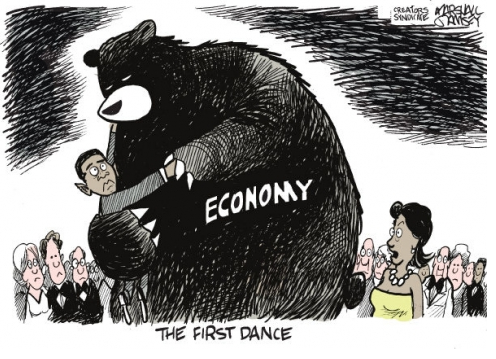

Democrat Barack Obama, inheriting an economic nightmare, is advised by Goldman Sachs to bring back Clinton’s (Goldman Sachs’) ”advisors” in order to continue to screw up everything as best they could… and he also brings in Goldman Sachs’ Timothy Geithner to take over from Goldman Sachs’ Hank Paulson to head the US Treasury →

No one notices that the Federal Reserve is not a branch of the Federal Government… rather, it is a private corporation (with a clever name) that has other member banks as its shareholders… this means that a central banking corporation has major control over the US Government →

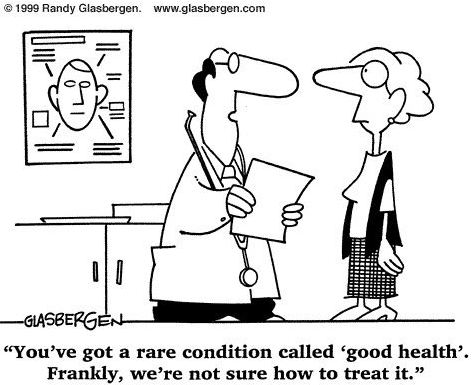

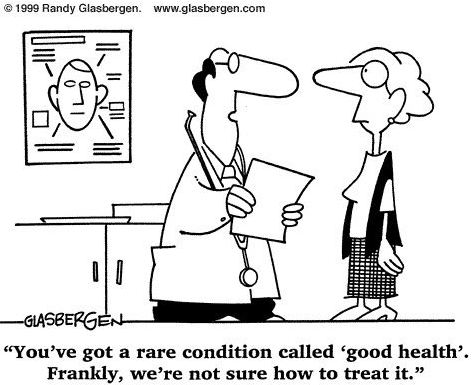

President Obama pushes through free medical care for all while the economy and jobs continue down the tube… no one seems to understand that “medical” care and “health” care are not the same things… or that there is no way to pay for any of this →

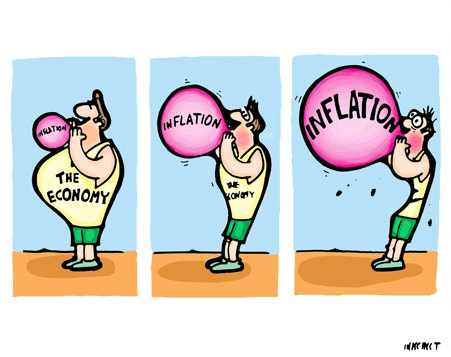

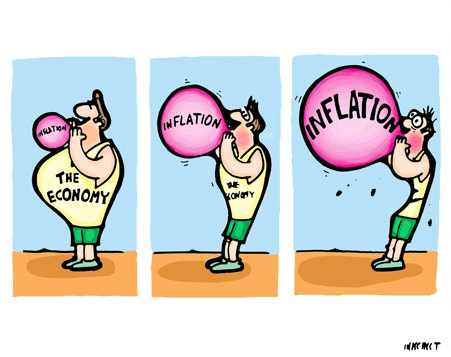

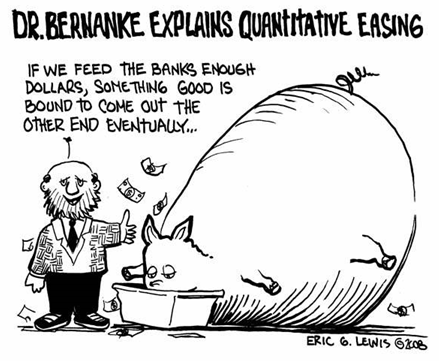

Obama’s choice for Federal Reserve Chairman, Ben Bernanke, (Greenspan’s longtime sidekick) who had pledged to “drop money from helicopters” to stimulate the economy, lowers interest rates back to 0%, promises to keep rates there until late 2013, and begins to print money “like mad”→

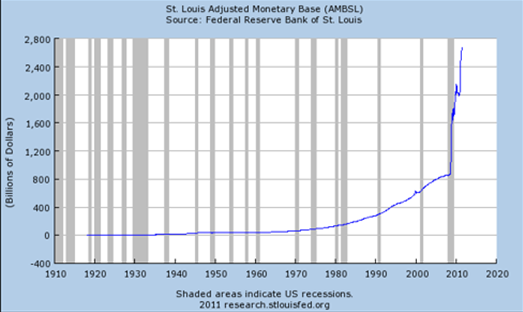

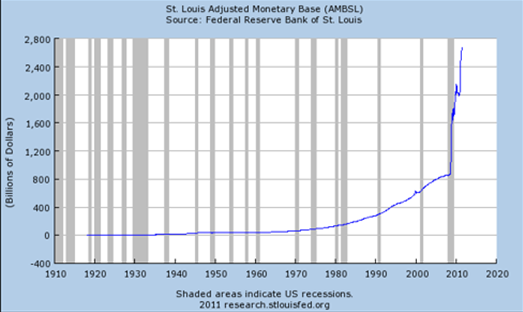

Bernanke goes on the television show “60 Minutes” and, with a straight face, states that “the Fed does not print money” (which is true because they actually just add digits to their computer screen and then “lend” the money into existence via fractional-banking)… unfortunately the following is an actual chart, but it is still a cosmic joke of sorts… a chart released by the Fed itself showing the amount of their “money creation” →

the total costs of both the US Government and the Federal Reserve “loans and guarantees” reach $14-trillion; attempting to stop a “Second Great Depression,” the US Government starts throwing money everywhere… the result is that the government becomes the latest “person” to push the stock market up into a new, strong bull market… a process that will (hopefully) be difficult to repeat again in the near future →

Congress is unable to pass any legislation or regulations because of the new fad of “constant bickering,” so in October of 2011, with little fanfare, the FDIC and the SEC pass new rules that effectively, once again, prevent “deposit banks” from acting like risky ”investment banks” (effective early 2012) →

the deposit banks immediately begin working to block these new rules →

ultimately, nothing will be permanently fixed, although the current stock bull market has the ability to continue on quite strongly until it doesn’t want to any longer (since the stock market and the economy are not the same thing)… future problems will include: diminished worth of paper currencies, hyper-inflationary commodity prices, shrinking oil, mineral and water supplies causing chronically spiking prices, commercial property defaults and foreclosures, a further drop in residential real estate prices, corporate and government pensions being looted, tax revenues falling at the state level, state municipal bonds defaulting (and the Fed buying them just like it did with the bank’s toxic mortgages), chronic unemployment… AND we need to work to fix our problems ahead of time and we need our hard earned money to be held by an investment advisory, like MarketCycle Wealth Management, that can move with what’s happening in the world and with the potential to generate profits even in down markets… buy-&-hold is likely to be dangerous going forward →

but the economic/business/market cycle will repeat again, just like in the movie “Groundhog Day” (see top photo) where Bill Murray has difficulty learning the lessons of a single day and then must re-live (repeat) the same day over and over and over and over, until the lessons are learned… except that humans (as a group) never really seem to permanently learn from our own history lessons →

There is so much activity out there that has the ability to throw the markets into long trends, either up or down, and MarketCycle Wealth Management is specifically designed to exploit any type of market condition. We’ve been bullish since March of 2009, but if everything starts falling off a cliff, we’ll shift our position (at an appropriate time) in order to make money on the way down!

Please feel free to share ↓↓↓

No comments:

Post a Comment