My Budget 360

Investing ideas for preserving wealth

It is fitting that we end the current decade just like we started it, with the bursting of bubbles. In the early part of the decade we were dealing with the fallout of the technology bust. That was quickly replaced by the even bigger housing bubble and that has now popped as well. The trillions lost by average Americans is incredible but in reality nothing was technically lost because the entire decade was one enormous Ponzi scheme and like all Ponzi schemes the wealth created is false. Bernard Madoff was simply the mascot of a decade built on phony money spewed out by the corporatocracy of Wall Street. What is even more troubling is how the actions taken by Wall Street are not being prosecuted in the same fashion as our justice system took on Bernard Madoff. The reason for that is the corporatocracy has legalized national bank robbery.

If you had $10,000 and put it in the S&P 500 at the start of the decade you would have performed worse than a person who merely stuffed the money into a mattress. The person who put their money into the NASDAQ at the start of decade is even in worse shape. We have experienced a lost decade. With employment, we now have the same number of people working as we did back in 2000. Only difference is in 2000 we had 280 million people and today we have 308 million people living in our country.

Take a look at the S&P 500:

Even after the raging rally since the March corporatocracy bailouts, the S&P 500 is still down nearly 25 percent from its January 2000 point. One of the broadest measures of our economy and we are still down 25 percent after a decade. But this isn’t even the worst case. Take a look at the NASDAQ:

The NASDAQ is down 45 percent from the start of the decade. The only other time in history a lost decade has occurred in stocks was during the Great Depression. Of course, many try to hide this stubborn fact but this is part of the new reality. Much of the wealth created in the past decade was built on a weak foundation of sand. A form of corporate chicanery that gave too much power to Wall Street. And the power is still there since no real reform has actually taken place since the meltdown started in 2007.

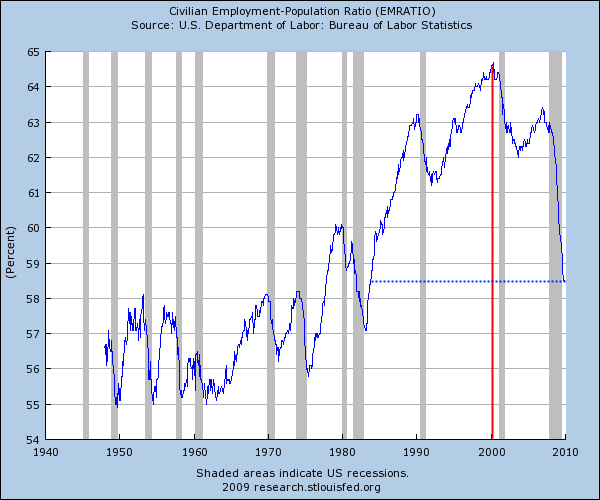

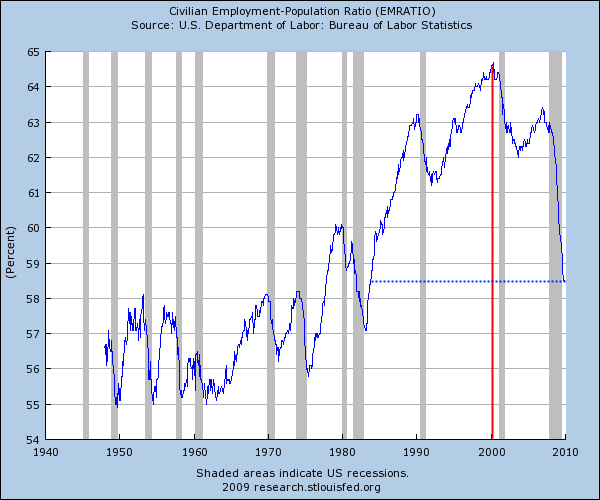

Yet if we looked more closely we would have noticed the bust more quickly. We never recovered from the tech bust in terms of employment:

Employment has really taken it on the chin. Our current unemployment rate of 10 percent does not include the underemployed. With those working part-time jobs and discouraged workers included the rate goes up to over 17 percent. The above chart is troubling because it shows that the average American didn’t really enjoy the fruits of the turbo capitalism of the decade. Much of the gains have been wiped out but if we look at how the corporatocracy is doing they seem to be doing fine:

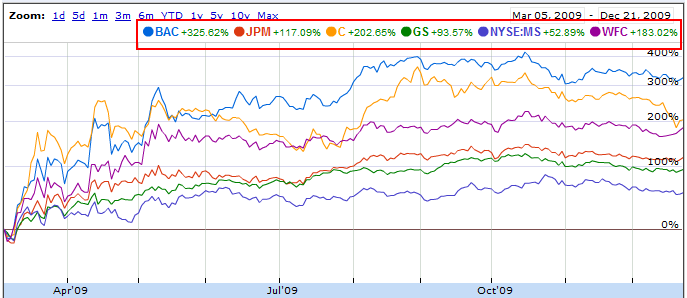

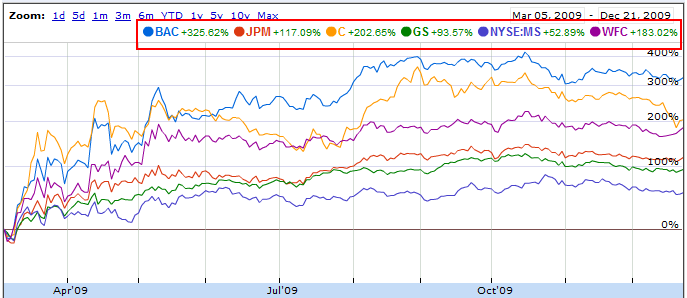

While the S&P 500 is up a stunning 63 percent from its March lows, some of the banking sector stocks are up 325 percent like Bank of America. JP Morgan is up 117 percent. Goldman Sachs is up 93 percent. The list goes on. The bailouts seem to be helping a few at the expense of the many.

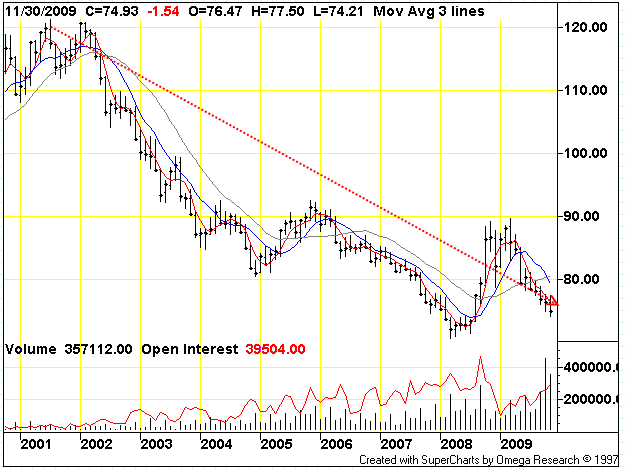

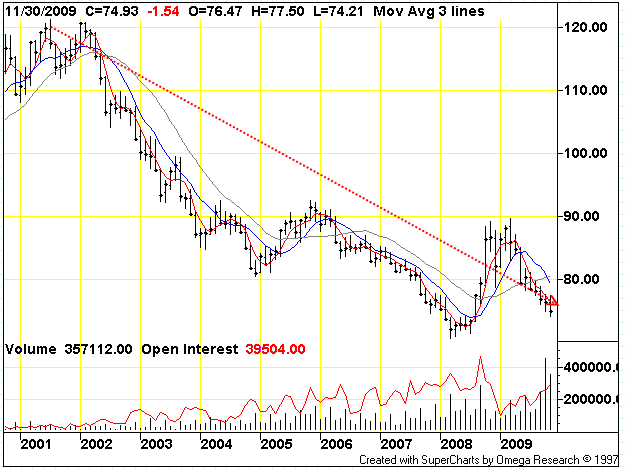

The same pattern holds for the healthcare sector with the recent bills being proposed. Their stocks are soaring. Want to take a guess as to why? The corporatocracy is running the show in D.C. and the lost decade is a product of their bubble blowing excess. The problem with the current system is Wall Street is run by a bunch of gamblers looking to make a quick buck. Now this wouldn’t be such a problem if the U.S. taxpayer wasn’t funding their shenanigans. But now, Wall Street has the explicit backing of the U.S. government. That is why the U.S. dollar is getting pummeled into the abyss. And that is another thing that we have lost during this decade:

So here we are a decade later with stocks below their 2000 point, unemployment in the double-digits, the U.S. dollar down by one-third, and housing values are quickly approaching their own lost decade point. What did we really financially gain in this decade? All this supposed financial innovation and this is what we get? I would say that the so-called innovation was an absolute failure. It was one gigantic Ponzi scheme. A con to convince average Americans that allowing Wall Street free reign would somehow result in them getting a piece of the gambler’s pie. In return, Wall Street took away any financial stability Americans once enjoyed and put the bill to them as well.

Americans also took part in this excursion. Not demanding restraint from their leaders or pushing for financial prudence. Many jumped into the mania and took out billions in home equity to gamble it up. This was nonsense. Yet this doesn’t come close to the trillions in ridiculous bets Wall Street placed. Derivatives on zany risk that had nothing to do with improving our economy. It was merely sophisticated gambling. And in the end, it wasn’t all that sophisticated since it blew up in their faces yet here we are bailing them out.

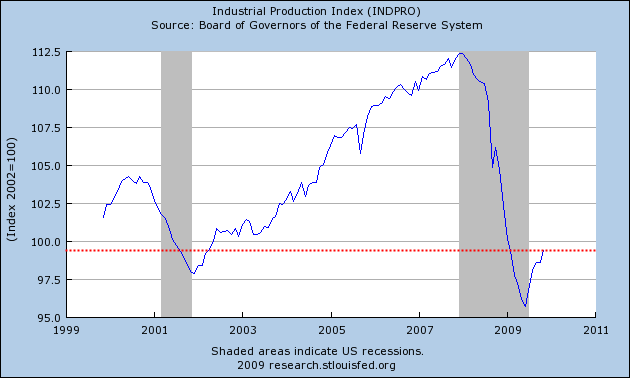

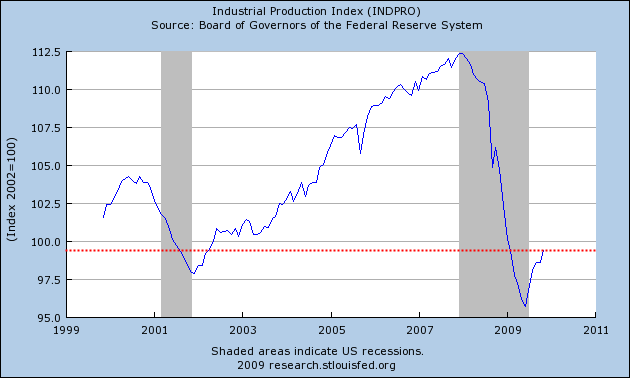

Industrial production has also been hit:

And much of this has to do with the financial sector sucking up an inordinate amount of resources from the productive side of the economy. Did people really think that selling houses to one another was a cornerstone to a healthy economy? Is a global power really the one that can have the most homes with expensive Jacuzzis financed by Wall Street debt?

The corporatocracy learned well in this Ponzi decade. It realized that an important line item expense was to lobby heavily. This was a lesson not taken to the extreme in the Great Depression. Sure you had your cronies back them but nothing like our current revolving door. So today, we are left with those who created the financial bubble also at the helm trying to fix it. We had serious regulatory reforms that came after the Great Depression. One major sticking point is Glass Steagall. That is, the division between bread and butter banking and more risky cowboy banking. You would think that this would be done by now but little push is being made in Congress for this. Those that try to bring this up are smacked down by the corporatocracy and their massive lobbying machine.

In fact, banks are back to making massive amounts of profits on the same gambling that got us here in the first place. If something isn’t done soon we will be back in some major financial crisis only in a few years. These gamblers want to call what they are doing “investing” but this is just another diversion to suck money away from taxpayers.

The irony of this all is the Federal Reserve which supposedly is there to ease out the bumps is actually causa prima for the problems. Just think of all the major crises since it came about in 1913:

-The Great Depression

-1970s stagflation

-Crash of 1987

-Technology bubble

-Housing bubble

And many more in between. The fact that we still haven’t audited the Fed speaks to the Ponzi decade. They don’t want to show us what they are holding for $2 trillion because they know once we see it we will realize the gig is up. They have exchanged good money for toxic assets. They are hoping inflation kicks in so they can resell the junk and basically the average American won’t know that the Ponzi scheme is still going on. If one man Bernard Madoff was able to keep a $50 billion Ponzi scheme going for 15 years can you imagine what the central bank can do?

No comments:

Post a Comment